eSave is an independent web application, fully managed by MACS and offered to financial institutions as Software as a Service (SaaS). It works independently from the FI’s internal management and information systems in order not to interfere with FI’s IT security regulations. No sensitive client data is shared with eSave. Other, deeper integration models with FI’s systems are also possible.

eSave can evaluate the environmental, social, and governance

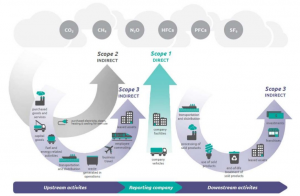

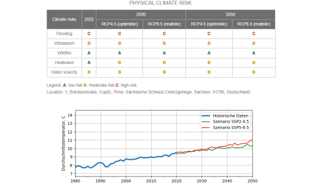

eSave can evaluate the environmental, social, and governance eSave leverages location intelligence, climate modelling,

eSave leverages location intelligence, climate modelling,